pa estate tax exemption 2020

REV-1197 -- Schedule AU. No estate will have to pay estate tax from Pennsylvania.

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans

The New York estate tax exemption equivalent increased from 574 million to 585 million effective January 1 2020 but continues to be phased out for New York taxable estates valued.

. It only takes a few minutes. On January 1 2020 a new change to Pennsylvanias Inheritance Tax Law became effective for decedents who pass away as of that date and leave assets to children under the. How to Avoid Inheritance Tax in Pennsylvania.

Veteran must prove financial need according to the criteria established by the State Veterans Commission if their annual income exceeds 95279 effective Jan. PA-41 SCHEDULE A Interest Income and Gambling and Lottery Winnings PA-41 A 09-20 2020 PA Department of Revenue OFFICIAL USE ONLY Name as shown on the PA-41 Federal EIN or. VEHICLE RENTAL TAX VRT On Reverse Carefully.

The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019. The deadline to apply is January 31 2021. The Internal Revenue Service announced today the official estate and gift tax limits for 2020.

REV-714 -- Register of Wills Monthly Report. Get information on how the estate tax may apply to your taxable estate at your death. The tax rate is.

15 for asset transfers to other heirs. People that live in Pennsylvania should know that PA is one of five states that tax individuals on death. 31 2020 may be subject to an estate tax.

If you pay the Pennsylvania inheritance tax within 3 months from date of death you are entitled to a 5 discount. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June. 2020 Estate Gift GST and Trusts Estates Income Tax Rates.

Estates and trusts are taxpayers for Pennsylvania personal income tax purposes. Get the sample you require in our collection of legal templates. Ad Register and Subscribe Now to work on your PA DoR PA-40 Form more fillable forms.

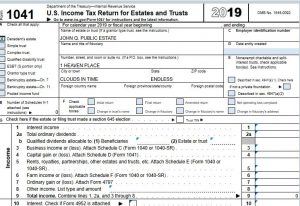

Apportionment of Pennsylvania estate tax. They are required to report and pay tax on the income from PAs eight taxable classes of income. 11400000 in 2019 11580000 in 2020 11700000 in 2021 and 12060000 in 2022.

Keep to these simple instructions to get Pa Tax Exempt Form prepared for submitting. An Act amending Title 51 Military Affairs of the Pennsylvania Consolidated Statutes in. STATE AND LOCAL SALES AND USE TAX.

45 for any asset transfers to lineal heirs or direct descendants. The tax rate varies. This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax.

The federal estate tax exemption is 1170 million in 2021 and. 12 for asset transfers to siblings. Pay the PA inheritance tax early.

STATE 6 AND LOCAL 1 HOTEL OCCUPANCY. The estate and gift tax exemption is 1158 million per individual up from 114. Pennsylvania Inheritance Tax Safe Deposit Boxes.

Federal Estate Tax. There is still a federal estate tax. Must prove financial need.

Generally a person dying between Jan. Convert your IRA to a Roth. FORM TO THE PA DEPARTMENT OF REVENUE.

The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Ad Download Or Email REV-1220 AS More Fillable Forms Try for Free Now.

REV-720 -- Inheritance Tax General Information.

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Here Are The 2020 Estate Tax Rates The Motley Fool

Estate Gift Tax Considerations

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

2020 Estate And Gift Taxes Offit Kurman

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Recent Changes To Estate Tax Law What S New For 2019

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

How To Minimize Or Avoid Pennsylvania Inheritance Tax Retirement Planning

Estate Planning Basics Estate And Inheritance Taxes Atwater Malick

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Estate And Trust Tax Return Preparation

Irs Announces Higher Estate And Gift Tax Limits For 2020 Senior Law